It's Not Just a Symbolic Train Wreck

ESG is responsible for literal train wrecks across the country.

Another week, another train wreck. I wrote an article on how Biden’s energy policies are a very symbolic train wreck here. But is ESG to blame for the literal train wrecks happening all over the country? Read on.

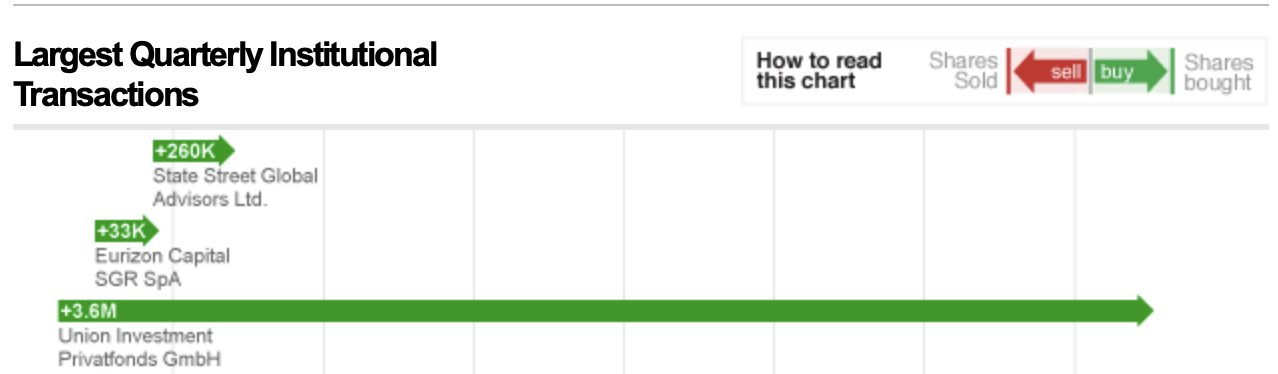

Like Norfolk Southern, is Canadian Pacific Railway more focused on woke virtue signaling through ESG than safety? Let’s take a look at some recent investment moves from Union Investment into Canadian Pacific.

It looks like Union Investment moved large transactions into Canadian Pacific over the last quarter. Did they move into the boardroom too?

It doesn’t even take a deep dive onto Union Investment’s website to see that they appear far more focused on woke ESG “sustainability” than returns.

How long until they realize “stepping up on our engagement activities” may violate anti-trust laws? The very reality that major banks and investment firms, including Union Investment, are increasingly colluding to deny financing not just to fossil fuel producers, but to agriculture and timber as well is an affront to the free market and antithetical to antitrust laws.

If you’re reading and are not sure what anti-trust laws are, here’s the definition from the Department of Justice: “these laws prohibit business practices that unreasonably deprive consumers of the benefits of competition, resulting in higher prices for products and services.”

Former Ambassador C. Boyden Gray wrote research on how there are liability risks for the ESG Agenda to charge higher fees and rig the market. Here are the main points:

Federal antitrust laws explicitly prohibit collusion and “hub and spoke” conspiracies, in which companies for a cartel to restrain market competition.

The Employee Retirement Income Security Act requires most employer retirement plans to act “solely in the interest of the participants and beneficiaries.” This fiduciary duty means investment managers are expected to prioritize financial returns over political views.

Meddling with existing contracts or prospective contracts is called tortious interference. Aggressive strategies used by environmentalist organizations to influence banks’ lending decisions and de-bank companies based on industry could be challenged on these grounds.

Public shaming campaigns are driving the trend to give more funds to companies who talk the right talk on issues like climate change, instead of to companies that offer the highest return on investment. The ESG movement wrongly bullies corporations into ignoring their duty to provide profitability for shareholders, in order to appease a vocal minority of progressive activists. And some major firms, like BlackRock, are capitulating.

A full 5% of Norfolk Southern’s annual budget is dedicated to virtue signaling ESG. Norfolk Southern reported $12.7 billion in revenue last year. Even assuming ESG Assume ESG was only 5% of their $8 billion in operating expenses, then that is $400 million.If you look at their Wall Street performance versus miserable service to customers (graphic attached in photo), you can see that they have been rewarded for that effort - it is not making customers happy.

I wrote in an article for Epoch Times:

“A free market is no longer free when the major financial players are colluding—not behind the scenes but out in the open—to gut politically targeted businesses while forcing dollars into their own “green” investments. That’s exactly what’s happening on Wall Street with the rise of ESG investing. Energy companies that don’t toe the line on progressive pet projects risk losing access to capital and even having existing contracts terminated. It’s happening all over the country, as companies from The North Face to BlackRock are boycotting fossil fuels and as shady shareholder tactics are being used to take over oil companies.

“These cartel-like tactics are a flagrant violation of longstanding federal antitrust laws. Corporations are legally barred from engaging in group boycotts. These rules were set into place to protect consumers from conspiracies to manipulate prices, constrain competition, and create politically or socially favored companies that limit consumer choice.”

And here’s the reality, banning fossil fuels will not eliminate them. Instead, it will drive up the cost of everything, even as Americans are already buckling under the weight of the Biden Administration’s energy policies. Energy powers our modern lives.

Wondering more about how ESG is being weaponized? Watch this interview I did with energy and finance expert Rupert Darwall on why he thinks ESG is “the biggest threat to American capitalism since the 1930s.”